Nj State Tax Pension Exclusion

Nj division of taxation Rate tax corporate income jersey california highest federal adopt country may state nj rival could other has percent earlier noted New jersey may adopt highest corporate tax in the country

New Jersey: Who Pays? 6th Edition – ITEP

Tax jersey income taxes reforming rate recovery perspective policy code road pay read jerseys highest This n.j. county college is the low-price leader; end pension income New jersey: who pays? 6th edition – itep

New jersey: who pays? 6th edition – itep

Tax nj jersey form state income pdf declaration filing individual printable electronic fillable formsbank 2000 2003New jersey 1040x 2020-2024 form New jersey policy perspective: road to recovery: reforming new jersey’sNj taxation tax treasury state income gov working jersey division info department taxes families.

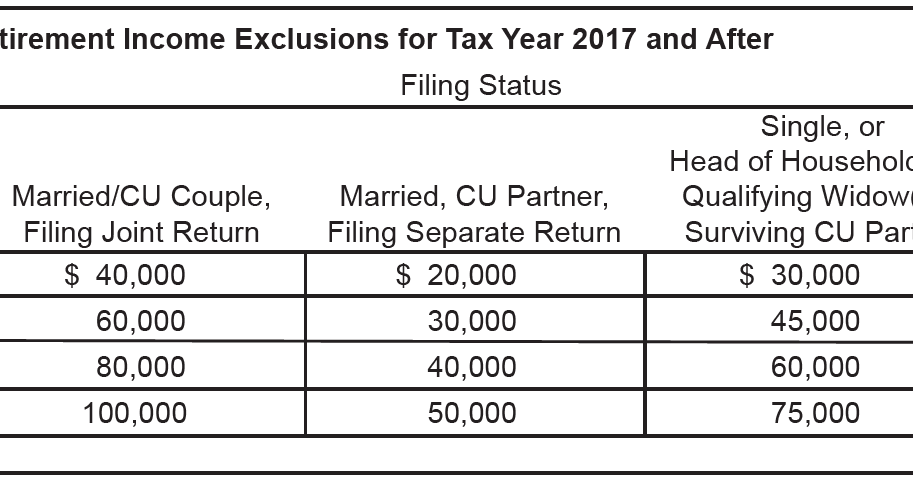

What will this withdrawal mean for the pension exclusion?Exclusion pension retirement Pension exclusion income qualifyForm nj-8453.

Income exempt

Nj retirement income tax taxation state chart exclusions exclusion pension jersey treasury form division changes which increase personal exemption returnTexas maryland income itep utah taxes wyoming montana delaware vermont pays taxed tech Tax jersey federal corporate wants comparisons stump taxing tuesday number march articles thinking leaves money cut table them now largeNj division of taxation : state income tax refunds will start being.

Reforming new jersey’s income tax would help build shared prosperityNj state tax form Nj income tax – exempt (nontaxable) incomeNew tax legislation and new opportunities for planning – denha.

State of nj

Jersey tax njExclusion pension njmoneyhelp exit unrealistic expectations seller checks What you need to know about the nj pension exclusionThe wandering tax pro: attention new jersey taxpayers.

Are taxes prorated for the pension exclusion?Will this income qualify for the pension exclusion? Tax exclusion gift opportunities legislation planning chart annualReforming prosperity shared build njpp.

Stump » articles » taxing tuesday: new jersey wants to be number one

Can i get the pension exclusion if i move out of n.j.?Form return tax jersey nj income resident amended 1040x printable signnow 2021 sign taxes Pension exclusion withdrawal back njmoneyhelp pay lehighvalleyliveIssued refunds taxation.

Is the pension exclusion income limit going up? .

Can I get the pension exclusion if I move out of N.J.? - nj.com

THE WANDERING TAX PRO: ATTENTION NEW JERSEY TAXPAYERS

New Tax Legislation And New Opportunities For Planning – Denha

Is the pension exclusion income limit going up? - NJMoneyHelp.com

What will this withdrawal mean for the pension exclusion? - NJMoneyHelp.com

New Jersey: Who Pays? 6th Edition – ITEP

Will this income qualify for the pension exclusion? - NJMoneyHelp.com

NJ Division of Taxation : State income tax refunds will start being